cash flow from assets equals

So for US we have. Operating cash flow minus the change in.

Cash flow from assets OCF Change in NWC Net capital spending Cash flow from assets 4084 1210 3020 Cash flow from assets 146 The cash flow from assets can be positive or negative since it represents whether the firm raised funds or distributed funds on a net basis.

. Equals the sum of the firms cash flow to creditors and its cash flow to stockholders. Net capital spending is money you spent on fixed assets minus money received from the sale of fixed assets. Cash flow from assets cash flow to creditors cash flow to stockholders.

Thats because the FCF formula doesnt account for. The cash flow identity states that cash flow from assets equals cash flows to ____. Operating cash flow plus the cash flow to creditors plus the cash flow to shareholders.

N Net capitalspending. However cash flow to stockholders would be replaced by cash flow to the owner in case it is a private business. Cash Flow from Assets.

However it does not factor in money from other financing sources such as selling stocks or debts to offset negative cash flow from assets. From the cash flow identity above this 87 cash flow from assets equals the sum of the firms cash flow to creditors and its cash flow to stockholders. Cash flow from assets is defined as.

So cash flow from assets is 900 minus 200 minus 100 is equal to 600. Cash flow from assets is the aggregate of sum of all cash flows relating to the assets of a business. Cash Flow to Creditors Cash Flow to Stockholders Click again to see term.

Up to 24 cash back The total cash flow from assets is given by operating cash flow less the amounts invested in fixed assets and net working capital. Cash flow to creditors is equal to. Cash flow from assets refers to a businesss total cash from all of its assets.

Cash Flow from Assets SHOULD BE Cash Flow to Stockholders Cash flow to Creditors. So the cash flow from assets was. Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow.

Ending long-term debt minus. Cash flow from assets equals. Creditors and bondholders b.

The second equation is what we will refer to as the Cash Flow Identity. The cash flow to shareholders minus the cash flow to creditors. It can be computed as.

Payment of income taxes. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow. Creditors and stockholders c.

The cash flow identity states that cash flow from the firms assets is equal to the cash flow paid to ______ to the firm. Cash Flow from Assets Calculator. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

Beginning long-term debt minus ending long-term debt plus interest paid. O The same as the Net Working Capital O cash flow to creditors cash flow to stockholders O cash flow to creditors - cash flow to stockholders cash flow to creditors x cash flow to stockholders O cash flow to creditors cash flow to stockholders. Tap card to see definition.

While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow. Cash flow from assets plus cash flow to stockholders. Operating cash flow formula.

Assets Liability Equity then. Ending total debt minus beginning total debt plus interest paid. What is the cash flow from assets of this firm based on CFFA method 2 CFFA Method 2 CFCR CFSH CFCR interest paid net new borrowing o CFCR 44679 11412 35001 - 1119823 999244 -29587 CFSH dividends paid net new equity.

Beginning total liabilities minus ending total liabilities plus interest paid. Cash Flow From Assets. It determines how much cash a business uses for its operations with a specific period of time.

Means that the firm raised more money by borrowing and selling stock than it paid out to creditors and stockholders. Indicate whether the statement is true or false. W Changes in net working capital.

Equity investors and stockholders. Cash Flow from Assets. Click card to see definition.

Which of the following increases a firms cash flow that can be used for capital spending. While the financial definition of operating cash flow treats interest as a financing expense In order to find cash flow from assets we need to find capital spending too. Cash flow from assets Cash flow from operations - Change in Net working capital Changes in fixed assets.

Cash flow from assets equals cash flow to creditors plus cash flow to stockholders. This results in the following cash flow from assets calculation. Equity investors and the government d.

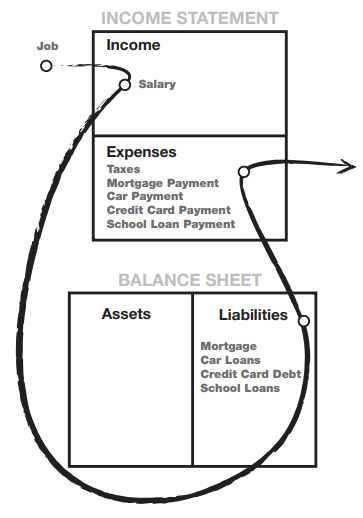

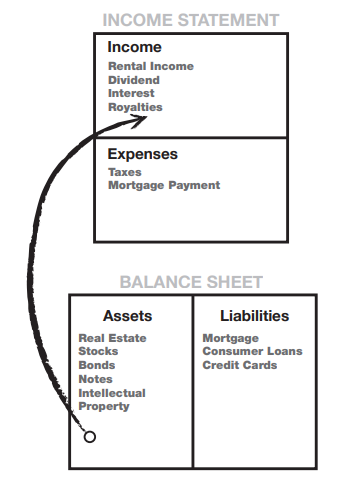

How To Identify A Cash Flow Pattern Of An Asset From Rich Dad Poor Dad

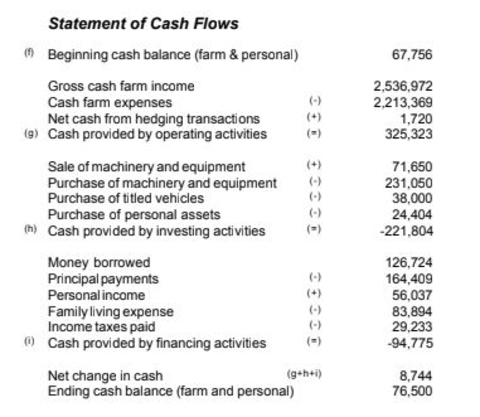

Statement Of Cash Flows Umn Extension

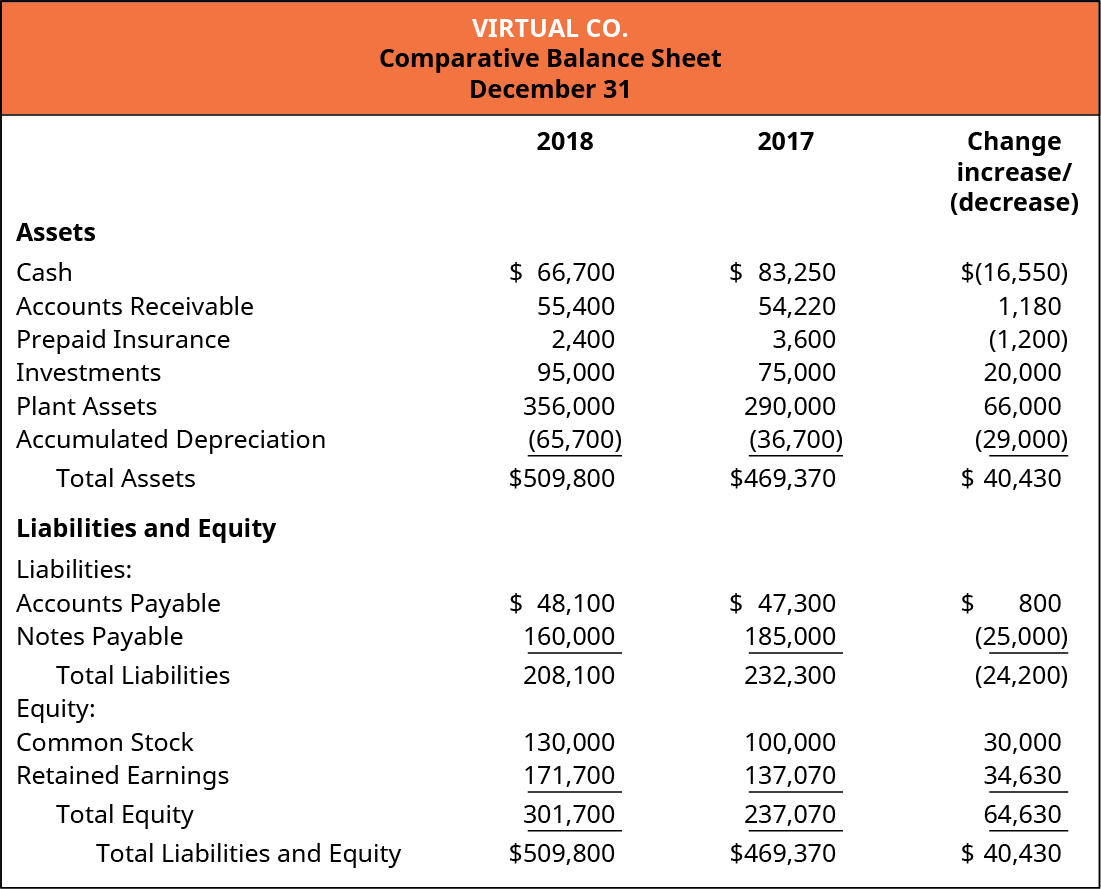

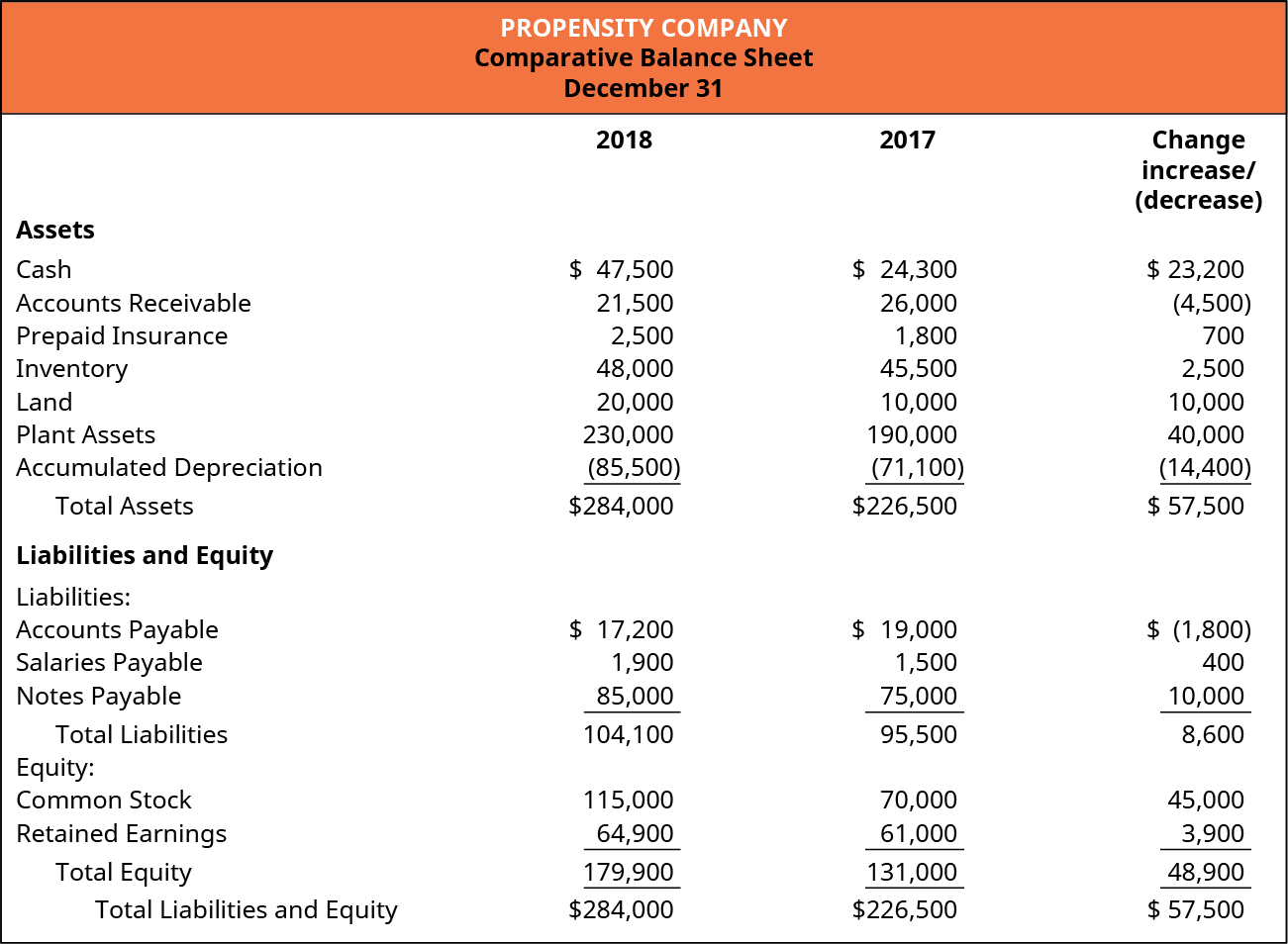

Prepare The Completed Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

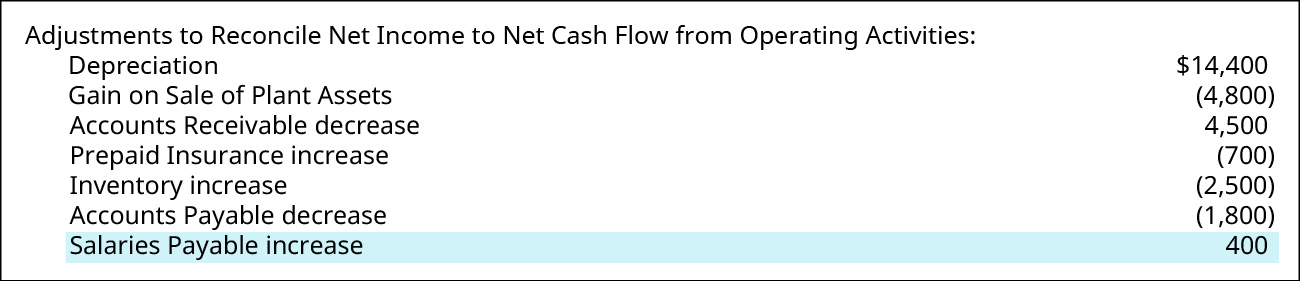

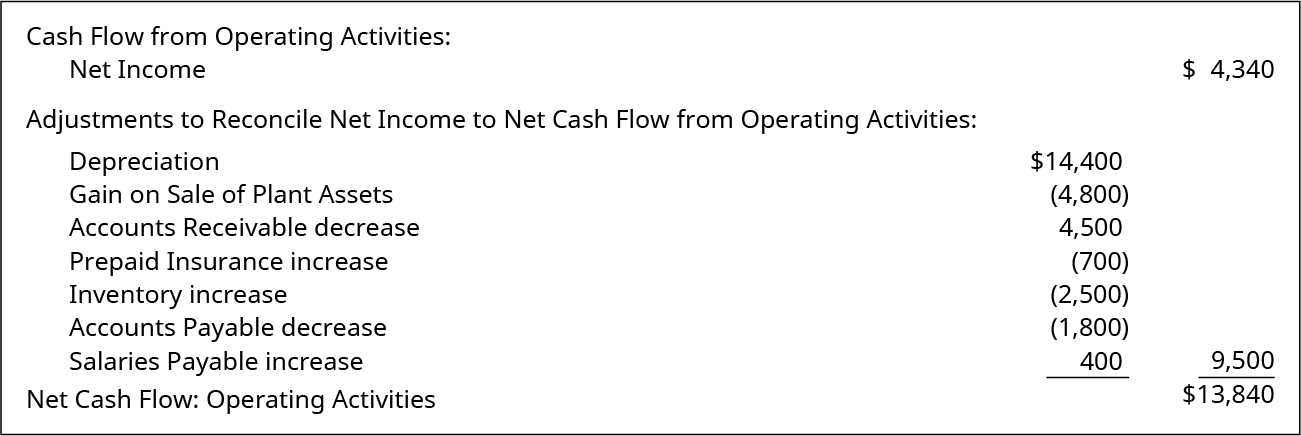

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Cash Flow Analysis Examples Step By Step Guide

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Operating Cash Flow Formula Calculation With Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow And Business Combinations The Cpa Journal

How To Identify A Cash Flow Pattern Of An Asset From Rich Dad Poor Dad

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Net Income Vs Cash Flow Accounting Interview Question

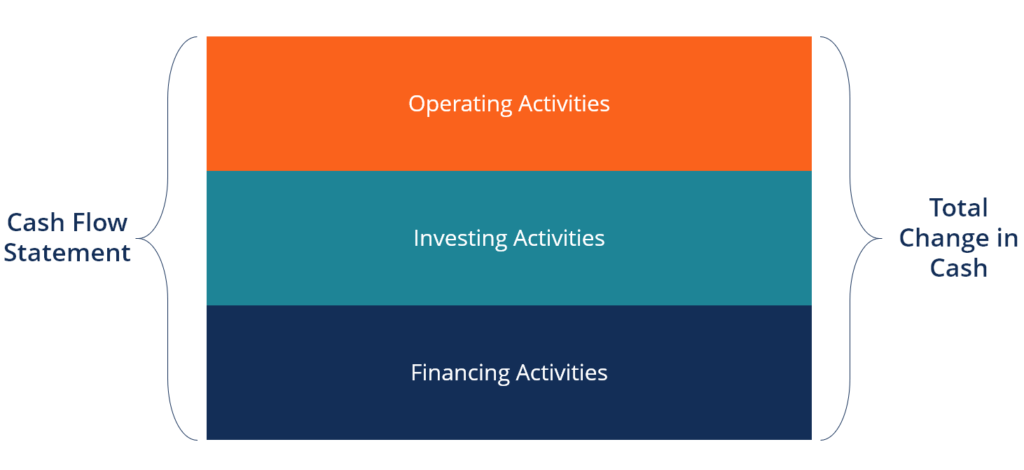

Cash Flow Statement How A Statement Of Cash Flows Works

Net Cash Flow Formula Definition Investinganswers

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities